Why Your Accountant Secretly Dreads Your Tax Season (And How to Fix It)

2025-07-11

Every January, freelancers around the world perform the same ritual: frantically gathering receipts, searching through email attachments for invoices, and trying to remember if that £47 Amazon purchase was "business equipment" or just another impulse buy.

Meanwhile, accountants everywhere brace themselves for the annual avalanche of shoeboxes, USB drives filled with randomly named files, and spreadsheets that would make Excel itself weep.

But here's the thing nobody talks about: your disorganized finances are costing you money in ways you haven't even considered.

The Hidden Cost of Financial Chaos

Consider this scenario: You're a freelance consultant who's been using a mix of Google Sheets, iPhone photos of receipts, and a "definitely going to organize this later" folder on your desktop.

When tax season arrives, your accountant quotes you £850 for what should have been a £300 job.

Why? Because instead of focusing on tax strategy and legitimate deductions, they spend 6 hours just organizing your data into something usable.

This story isn't unique. Disorganized freelancers pay 2-3x more in accounting fees because their accountants become expensive data entry clerks instead of financial advisors.

The Multi-Currency Challenge

If you're working with international clients, the complexity multiplies. You're juggling:

- Multiple currencies that need proper tracking for tax purposes

- VAT regulations that vary by client location

- Payment tracking across different currencies and time zones

- Proper documentation for HMRC compliance

Most freelancers handle this with a combination of PayPal screenshots, bank statements, and hope. Their accountants spend hours cross-referencing dates and trying to figure out which £300 payment corresponds to which invoice.

What Accountants Actually Want (But Won't Tell You)

Based on conversations with UK accountants who work with freelancers, here's what they desperately wish their clients would provide:

1. Properly Categorized Expenses

Not just "business expenses" - specific categories like:

- Equipment & Technology

- Software Subscriptions

- Office Supplies

- Meals & Entertainment

- Mileage with journey details

2. Clean Invoice Records

- Sequential numbering (no random gaps)

- Consistent formatting

- VAT numbers properly recorded

- Currency clearly indicated

3. Payment Tracking That Makes Sense

- Which invoices are paid vs outstanding

- Payment methods and references

- Partial payment tracking

- Multi-currency payment reconciliation

4. Mileage Documentation with HMRC Rates

- Journey dates and destinations

- Business purpose for each trip

- Accurate calculations using current HMRC rates (45p per mile for first 10,000 miles, then 25p)

- Different rates for different vehicle types (24p for bikes, 20p for bicycles)

One accountant put it this way: "When a client hands me a properly organized export with all this information, I can focus on finding them legitimate deductions and tax savings instead of playing detective with their receipts."

The Multi-Currency Tracking Problem

Here's a specific example that breaks most systems:

You invoice a German client €1,200 in March, they pay €800 in April and €400 in May. Meanwhile, you've invoiced a US client $2,000 who pays via three partial payments across two months.

Your UK VAT return needs accurate tracking of these transactions. Your tax return needs proper documentation. Your cash flow planning needs real-time tracking of what's actually been paid vs what's still outstanding.

Most freelancers give up and just estimate. Their accountants spend hours trying to reconstruct the actual payment timeline.

A Better Way: The Organized Freelancer's Approach

After watching too many talented freelancers struggle with financial admin, I built a system that handles the complete workflow properly.

Here's what organized financial management actually looks like:

Professional Client Experience

Instead of emailing PDF attachments that get lost in spam folders, clients get secure portal links. No registration required - they just click, view their invoice, and can report payments directly.

Smart Multi-Currency Organization

Each currency is tracked separately in your chosen amounts. Your dashboard shows exactly how much you've earned in pounds vs euros vs dollars, with clear breakdowns and payment status for each currency.

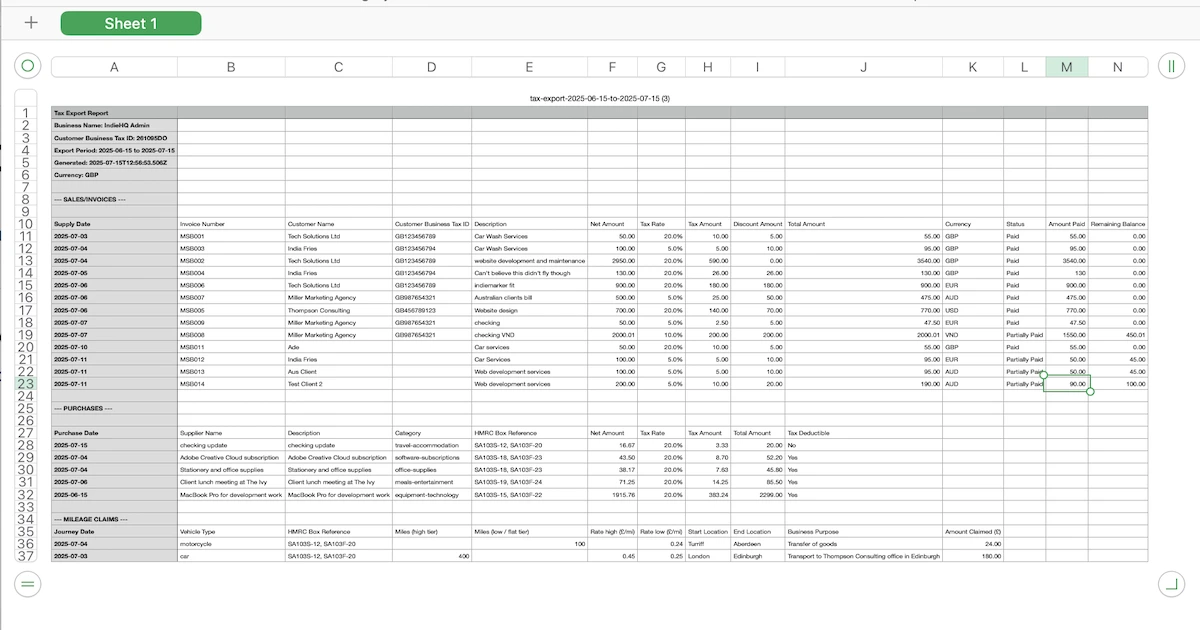

Tax-Ready Exports

Everything organized exactly how accountants want it: sales/invoices section, purchases section, mileage claims section with proper HMRC rate calculations. VAT information included where applicable.

Smart Payment Management

Partial payments, overdue tracking, payment method documentation - all handled automatically. You know exactly what's paid, what's pending, and what needs follow-up.

The Real ROI of Getting Organized

Scenario 1: Disorganized Freelancer

- Accounting fees: £850

- Time spent on admin: 40+ hours

- Missed deductions: ~£300

- Client payment delays: 15-20 extra days average

- Stress level: Maximum

Scenario 2: Organized Freelancer

- Accounting fees: £300

- Time spent on admin: 5 hours

- Missed deductions: £0 (accountant can focus on optimization)

- Client payment delays: 5-8 days average

- Stress level: Minimal

Annual savings: £850+ in fees, £300+ in missed deductions, plus 35+ hours of time

Getting Started: The Minimum Viable Organization

You don't need to overhaul everything immediately. Start with these basics:

- Choose one system for all invoicing (stop using multiple tools)

- Categorize expenses as you enter them (not at year-end)

- Track mileage with journey details and business purpose

- Track currencies separately without mixing them up

- Document payment methods and references properly

The goal isn't perfection - it's having organized data your accountant can actually work with.

Why This Matters in 2025

Making Tax Digital (MTD) requirements continue to expand. International client work is becoming more common. Proper documentation standards are getting stricter.

The freelancers who adapt to systematic financial management will thrive. Those who stick with ad-hoc methods will find themselves spending more on compliance and missing out on legitimate tax savings.

Your accountant should be your strategic advisor, not your data entry clerk.

Take Action

If you're tired of overpaying for accounting fees and want to see what organized freelancer finances actually look like, I've built a system that handles exactly this workflow at IndieHQ.org.

It manages multi-currency invoicing, client portals, payment tracking, expense categorization with tax deductible flagging, HMRC-compliant mileage tracking, and generates those tax-ready exports that make accountants efficient.

Currently £11.99/month because I believe freelancers should have access to professional financial tools without enterprise pricing.

But whether you use my tool or build your own system, the important thing is getting organized before next tax season.

Your accountant (and your bank account) will thank you.